Roaring Twenty-Twenties: Accelerating Energy Transition

This blog poses to ‘recreate’ the technical and economic prosperity of the 1920s in the 2020s, by gradual divestment in ‘old’ energy systems and investment in ‘new’ renewable industries.

It is summer 2020. We have ‘survived’ the first wave of Corona. The future is uncertain. Though the stock market is at an all-time high (weird), there is much talk about impending economic doom.

Kenneth S. Rogoff, a Harvard economist, recently claimed that “this is already shaping up as the deepest dive on record for the global economy for over 100 years. Everything depends on how long it lasts, but if this goes on for a long time, it’s certainly going to be the mother of all financial crises. I feel like the 2008 financial crisis was just a dry run for this.” He is certainly not the only pessimist (or realist?) out there. Market analysts anticipate the ‘worst’ financial crisis since 1929 and G20 leaders pledge to inject $5 trillion into the global economy in fight against coronavirus. The stage is certainly set for a period of epic economic downfall.

As the eternal optimist however, I present a different view. One that can propel us to a sustainable all-time economic high. If we play our cards right, I believe we could create another “roaring twenties” in the coming decade. The roaring twenties refers to the 1920s, a time of unprecedented cultural, technical and economic prosperity in the Western World. This was only a year (!) after the end of both World War I and the Spanish Flu, events that shook the foundations of human civilization to the core. After just a few years, the world, still shell-shock from these terrible events, managed to pull itself out of the dirt and into unparalleled times of prosperity.

Together with leaders around the world, I propose we do the same. A green recovery is essential as we emerge from the Corona crisis. The world will benefit economically, environmentally and socially by focusing on clean energy. Aligning economic stimulus and policy packages with climate goals is crucial for a long-term viable and healthy economy.

Before diving into the current ‘state of the system’ and explore options for green recovery that stimulate cultural, technical and economic growth, I’ll give some more historic context about the roaring twenties itself. If you are not interested in any (historical) context whatsoever, you can skip this part.

What Is This Roaring Twenties You Are Referring To?

The Roaring Twenties refers to the decade of the 1920s in Western society. It was a period of economic prosperity with a distinctive cultural edge in the United States and Europe, particularly in major cities such as Berlin, Chicago, London, Los Angeles, New York, Paris and Sydney. In France, the decade was known as the "années folles" ('crazy years'), emphasizing the era's social, artistic and cultural dynamism.

The period saw the large-scale development and use of automobiles, telephones, movies, radio, and electrical appliances being installed in the lives of thousands of Westerners. Aviation soon became a business. Nations saw rapid industrial and economic growth, accelerated consumer demand, and introduced significantly new changes in lifestyle and culture. The media, funded by the new industry of mass-market advertising driving consumer demand, focused on celebrities, especially sports heroes and movie stars, as cities rooted for their home teams and filled the new palatial cinemas and gigantic sports stadiums. In many major democratic states, women won the right to vote. The right to vote had a huge impact on society.

The spirit of the Roaring Twenties was marked by a general feeling of novelty associated with modernity and a break with tradition. Everything seemed to be feasible through modern technology. Anything was possible. New technologies, especially automobiles, moving pictures, and radio, brought "modernity" to a large part of the population. At the same time, jazz and dancing rose in popularity, in opposition to the mood of World War I. Perhaps it was because of the hardships endured in the years before that people had the need to change and improve. Nevertheless, it is a stark reminder that we are capable of much more than we think in a small time-frame.

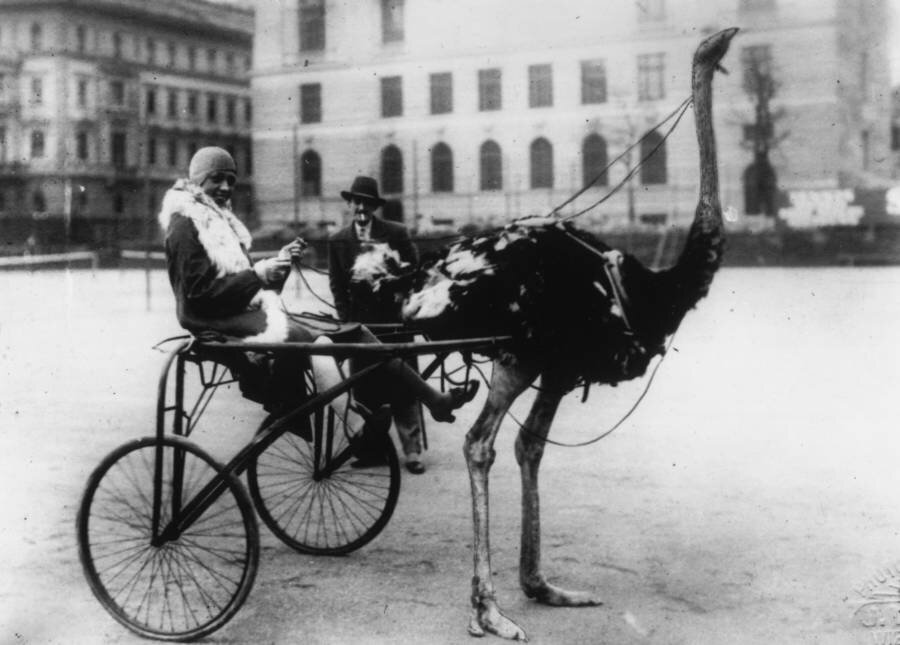

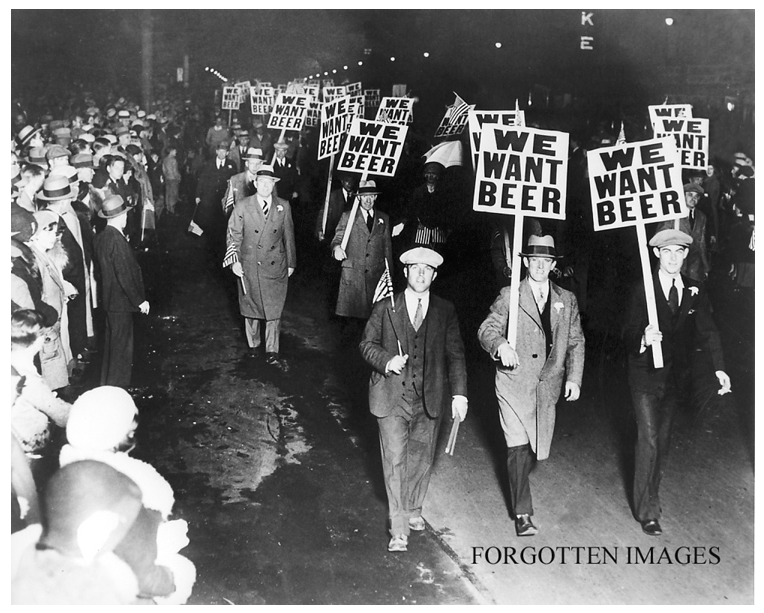

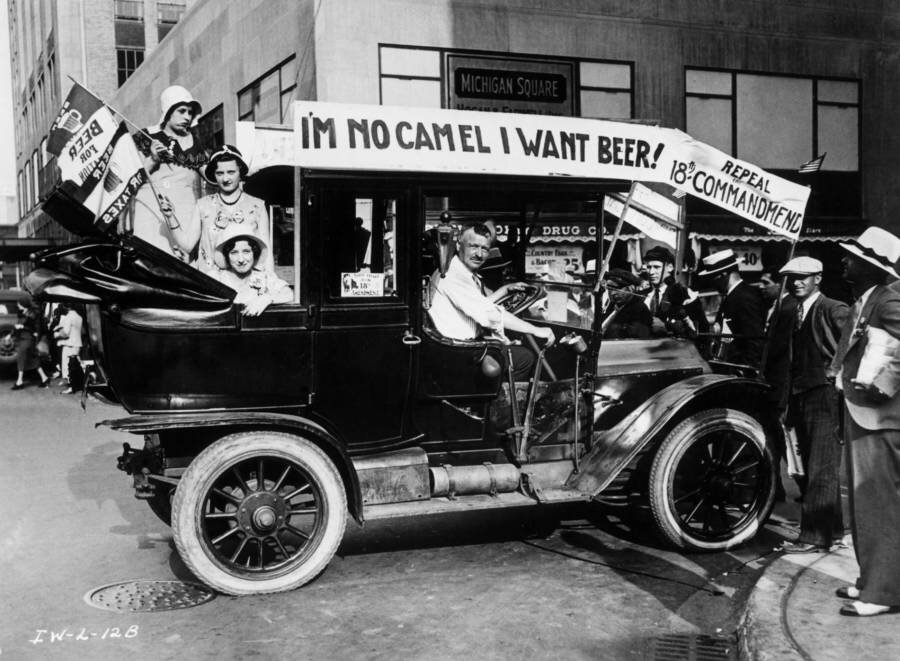

Below gallery gives you an impression of the roaring twenties, taken from allthatsinteresting.com. It’s a brilliant depiction of the zeitgeist of the age.

How Do We Create These Roaring 2020s?

Though I would never suggest to ‘recreate an era’, I am suggesting to create similar circumstances for growth and optimism. Unfortunately, it is not so simple to just follow a careful step-by-step plan to arrive at a perfect equilibrium of economic bliss. I do believe however, that a few principles will steer us in the right direction. Principles focused on sustainable job growth, decreasing our environmental footprint and decentralize our energy and economic system. Basically it boils down to the following:

Divest in the ‘old’ energy and economic systems

Invest in the ‘new’ renewable and decentralized economic systems

These can actually be combined: one could invest in the new by converting the old. Let me explain.

Divest in the Old…

First, one needs to define what is the old. With the ‘old’, I refer to the fossil-fuel based, centralized energy industries that are reliant on conservative economic models. They are sometimes referred to as Big Oil, or the Oil and Gas majors the likes of Shell, BP, Total etc. These companies, and all the ones dependent on them, are facing an existential crisis.

It is speculated that the current situation, a downfall in demand ignited by the Coronavirus outbreak with an oil-price war added on top, will hasten the peak for oil, gas and coal demand. According to Francesco La Camera, the Director-General of the International Renewable Energy Agency, the global crisis exposed “the deep vulnerabilities of the current system”. So what kind of vulnerabilities is he referring to? I believe it is the volatile financial status of the system.

The current energy system is worth a lot. According to Carbon Trackers, we are talking about a value of between 14-129 trillion dollars for fossil fuel assets alone and revenue streams of trillions of dollars annually. A trillion dollars is a million million dollars, or $1.000.000.000.000 in size. Despite its massive market cap, governments around the world provides numerous subsidies, both direct and indirect, to the fossil fuel industry. Conservative estimates put direct U.S. subsidies to the fossil fuel industry at roughly $20 billion per year; with 20 percent currently allocated to coal and 80 percent to natural gas and crude oil. European Union subsidies are estimated to total 55 billion euros annually. In short: the oil and gas industry is a massive market with many stakeholders and high-stakes interests involved. Should something happen to it, say a crash, we have a big problem.

… Because the Old could crash…

The Guardian stated that the Coronavirus outbreak could trigger a $25 trillion collapse in the fossil fuel industry. This scenario is referred to by some as the ‘carbon crunch’. The reason would be a combination of the dramatically decreased value of the proven reserves of oil and gas companies and a low demand for oil products.

Such a sudden collapse of immense proportions is undesirable, as it brings with it tremendous social and economic upheaval. A blow to fossil fuel companies could send shock-waves through the global economy because their market value makes up a quarter of the world’s equity markets and they owe trillions of dollars to the world’s banks. Everyone will feel the pain if such an amount of money disappears in a short time, you and me included.

If a gradual divestment in the old energy system is not undertaken, and the carbon crunch scenario becomes a reality, I foresee the possibility of oil majors having to be bailed out. Though this might seem ridiculous now, so was a negative oil price until only a month ago. So was the bankruptcy of Lehman Brothers in 2008. People do not believe the institutions they have lived with their entire life to fail, but they do.

The decline of the fossil fuel economy poses a significant threat to global financial stability. There is far more risk in the fossil fuel system than is conventionally priced into financial markets. Investors need to increase discount rates, reduce expected prices, curtail terminal values and account for the clean-up costs. Kingsmill Bond from Carbon Trackers stated: “Now is the time to plan an orderly wind-down of fossil fuel assets and manage the impact on the global economy rather than try to sustain the unsustainable.”

So what should we do to avoid a sudden carbon crush scenario?

… Perform gradual divestment and conversion of the Old

We have to realize that fuel and hydrocarbons in general are a necessity for modern man to survive. Be careful to note that I am not referring to fossil fuels, simply fuels. It is highly likely we will need the products, materials, and feedstock for the chemical industry derived from hydrocarbons for a long time to come (except land-based transport). My point is: these products do not have to be fossil-based. They can be either synthetic or bio-based. For example, DSM, a Dutch multinational corporation active in the fields of health, nutrition and materials, is investing heavily in bio-based ethylene as a replacement for fossil products including plastics. They call it the mass balance approach, where gradual addition of bio-based naphta is added to chemical products until it is fully bio-based. If the resources are circular and sustainable, and the end product can be broken down using pyrolysis, this would ensure a negligible environmental impact for hydrocarbons while still providing us with all the economic and social advantages that we currently have.

Re-configuring fossil fuel based products into sustainable synthetic and bio-based sources in a circular economy is a worthy cause.

DSM is working hard to increase the amount of bio-based material in their supply chain and aims for 60% circular bio-based feedstock for all their products by 2030.

To summarize, Big Oil faces an existential challenge in the decades ahead. Will it maintain focus as a sunset industry, cashing out its business model to grateful investors? Or, as is the case today, will it continue to reposition itself incrementally in sustainable fuels, EV infrastructure and sustainable energy markets? Let us look into the markets that should be on top of mind for the current leaders, shaping the geo-political landscape.

Invest In The New

Renewable energy sources are defined as those who replenish themselves over time, with a negligible environmental impact (the intricacies of the impact of renewables are spared for another article, let us assume the environmental impact is negligible especially when compared to fossil fuels). Renewables include bio-energy, geothermal, hydropower, ocean, solar and wind power. Most of these technologies focus on the generation of electricity, but storing energy or carbon sequestration (carbon capture and storage), as well as the production of clean hydrogen are among these. The global renewable energy market was valued at $928 billion in 2017, and is expected to reach $1,512 billion by 2025. This is a massive amount of money, though still an order of magnitude smaller than the oil and gas industry.

Why is investing in the New good?

Besides the obvious benefits of a still having a habitable planet for our children, investing in renewables and clean tech/energy has numerous economic and social advantages that trump the fossil fuel industry. These are the fact that they produce sustainable economic growth, and more jobs compared to fossil fuel industry.

Because sustainable economic growth

According to the Director of the International Renewable Energy Agency, Franscesco la Camera, accelerating investments in renewable energy would help tackle the climate crisis and would in effect pay for itself. “Governments are facing a difficult task of bringing the health emergency under control while introducing major stimulus and recovery measures,” La Camera said. “By accelerating renewables and making the energy transition an integral part of the wider recovery, governments can achieve multiple economic and social objectives in the pursuit of a resilient future that leaves nobody behind.”

This view is not only confirmed by ‘Green Guys’ who are biased towards clean tech and energy (like me). It is also confirmed by Goldman Sachs. According to analyst Michele Della Vigna and her colleagues, who have issued a research note for investors, investments in renewable energy are set to overtake those in upstream oil and gas for the first time in 2021. They think the clean energy field, including biofuels, will be a $16 trillion investment opportunity between now and 2030, a massive amount close to that of the oil and gas industry.

“Renewable power will become the largest area of spending in the energy industry in 2021, on our estimates, surpassing upstream oil and gas for the first time in history.”

So why is it exactly, that banks and investors are investing so heavily in renewables? Because they make more money out of it. Companies borrowing to finance new oil and gas exploration are paying up to 20% interest on those loans, while renewable energy developers are paying a mere 3%. That is a powerful economic incentive and paints a pretty clear picture of what the investment community thinks about the long term prospects for oil and gas.

Money talks. And in this case, it cannot stop talking about renewables and clean tech.

Because Jobs

It is widely believed that renewable energy and clean tech are powerful engines of job creation. Luckily this is also supported by data. According to this report from the Department of Economics and Political Economy Research Institute University of Massachusetts Amherst, investments in green energy will create 3 times the amount of jobs as opposed to oil and gas industry. These consist of direct effects, indirect effects and induced effects. Direct effects are the jobs created, for example, by retrofitting homes to make them more energy efficient or building wind turbines. Indirect effects are the jobs associated with industries that supply intermediate goods for the building retrofits or wind turbines, such as lumber, steel, and transportation. Induced effects are due to the expansion of employment that results when people who are paid in the construction or steel industries spend the money they have earned on other products in the economy.

This view is supported, again, by Goldman Sachs, stating that clean energy could drive $1 to $2 trillion a year in infrastructure investment between now and 2030 and create 15 to 20 million jobs globally. Investing in renewables will thus ensure job creation that could fill the gaping voids created by Corona and the oil price war.

And where to invest in?

Unless you are an investor who happens to stumble across my blog (hope you like it), it might be hard for you to think which kind of projects I am referring to. What I propose is to publicly (and privately where possible) invest in the generation and storage of clean energy, plus other clean technology which will improve our health and livelihood.

One clear example would be this proposal to construct a whopping 508 GW of windturbines in the Gulf of Mexico. If you’re wondering why the US is not ready to pepper the Gulf of Mexico with offshore wind turbines, that’s a good question. Hurricanes would be one answer. Nevertheless, the US is eyeballing the waters of the Gulf for a tidal wave of new offshore wind farms that would compete on cost with electricity markets in the region. That’s a rich plum indeed, when you consider the popularity of air conditioning in the coastal states of Florida, Alabama, Mississippi, Louisiana, and Texas — and the prospects for job creation as the US economy digs itself out from under the COVID-19 crisis. Plus, the construction of these vast arrays of turbines in the Gulf of Mexico can be combined with bringing it back to life, as it is currently a dead zone pretty much devoid of life.

A similar call is headed by businessman Ignacio Galán, the chairman and CEO of the Spanish renewables giant Iberdrola. He said the company would continue to invest billions in renewable energy as well as electricity networks and batteries to help integrate clean energy in the electricity. “A green recovery is essential as we emerge from the Covid-19 crisis. The world will benefit economically, environmentally and socially by focusing on clean energy,” he said. “Aligning economic stimulus and policy packages with climate goals is crucial for a long-term viable and healthy economy.”

And it is not just about energy production and storage. It is also about electric vehicles and hydrogen. President Emmanuel Macron announced a € 8 billion support plan for the auto industry in France. Citizens there can count on a substantial purchase premium of € 6000 to € 7000 if they purchase a new electric car. In five years, France should be the largest producer of electric and hybrid cars, Macron said. Now the country makes 240,000 a year; there should be a million by 2025. Germany also plans to become the largest producer of electric cars in the world, overtaking China next year. They are well-positioned with the construction of the new Gigafactory close to Berlin, as well as having one of the biggest car industries in the world. No matter which country ‘wins’ this race, we all benefit. Can you imagine the amount of jobs and reduction in local emissions this will bring to our cities?

It does not end there. The European Commission also plans billions in making buildings more energy-efficient and promoting green hydrogen as fuel. "No one in this field can claim to be ahead of the game, not even the Chinese," said CEO Francesco Starace of Italian energy company Enel this week. "So we can do that." Let's not repeat the mistake Europe made with solar cells and panels, Starace warned. At the beginning of this century, European companies were still ahead of the curve, but Chinese companies took over the market. It doesn't have to be that way with hydrogen, he thinks. "If we set up a production chain for that, let's try to control at least part of it," said Starace.

The 2020s are as roaring as we make it to be

Granted: the future is uncertain and in no way will the case I make in this article ensure economic bliss. I do feel however, that we have an important window of opportunity granted to us in a time of crisis. Major economies around the world are preparing stimulus packages. A well-designed stimulus package, with the proper monetary incentives focused on developing the production and storage of clean energy, could offer tremendous economic, social and environmental benefits. The next decade could be the new golden years, with the accelerated energy transition ushering in a time of unprecedented cultural, technical and economic prosperity. This time not just in the West, but worldwide.

Although I am not in a seat of power to make the decisions, I know the ones who are also propose to invest heavily in a green recovery. European politicians, companies, lawmakers and activists already called at the start of April for green investment to restart growth after the Coronavirus pandemic, saying fighting climate change and promoting biodiversity would rebuild stronger economies.

So let me end with asking you one last question. Has there ever been a time in the World, in which making the right choice for a better, more sustainable future, would also be the wisest choice for your wallet? We can do the right thing and make a butt-load of money, what’s not to like?

Personal Note

I know the situation is bleak for many in this crisis and it is my hope I do not come across as a knows-it-all. I am certainly no economist or otherwise monetary wizard (though I believe the numbers speak for themselves). I simply felt the message to accelerate the energy transition needed to be spread, as we all have so much to gain.

Furthermore, the history-savvy reader might want to notice that the Roaring Twenties was ended by the Wall Street Crash of 1929. This crash was the start of the Great Depression which brought years of hardship worldwide. It can therefore be said that great calamity both started and ended the Roaring Twenties. My point is, it took a World War to brake down the old and pave the way for these cultural and technical innovations to take root. In my articles, I try to look through a different, longer temporal lens. I was thinking: how will we look back to 2020 in 2030? Or 2050? I honestly believe a crisis is a time for both destruction, and creation, and if we use the cards we are dealt right we can make the world a lot better place.

References

Wikipedia - Roaring Twenties

Allthatsintersting - Roaring Twenties

Reuters - European politicians, CEOs and Lawmakers urge for green Coronavirus recovery

Cleantechnica - Goldman Sachs sees 16 trillion investment in renewables by 2030

The Guardian - Green Energy could drive Covid-19 Recovery

Oilprice - 110 Trillion Renewables Stimulus Package could create 50 Million Jobs

Cleantechnica - Dream Big, 508 GW Offshore Wind Potential for Covid-19 Recovery

Business Insider - More than 1 Million Oil Workers to lose Jobs in 2020

Financieel Dagblad - Groene Kickstart voor de Europese Industrie

Energypost - Jobs investing in Renewables beats Fossil Fuels