The Future(s) of Fossil Fuels - 2020

Big oil and the energy transition

Summary - 2020 is already the worst year for the oil industry ever. Even major oil and gas CEOs agree there might be no recovery after this crisis, certainly not to the ‘good-old-days’. The transition is among us. Grossly speaking, there are two transition pathways for the industry to follow: a gradual or a rapid transition. A sudden collapse of the industry - called a carbon crunch - could lead to economic disaster of epic proportions. The time is therefore now to plan an orderly wind-down of fossil fuel assets and manage the impact on the global economy rather than try to sustain the unsustainable.

2020. The worst year for oil ever

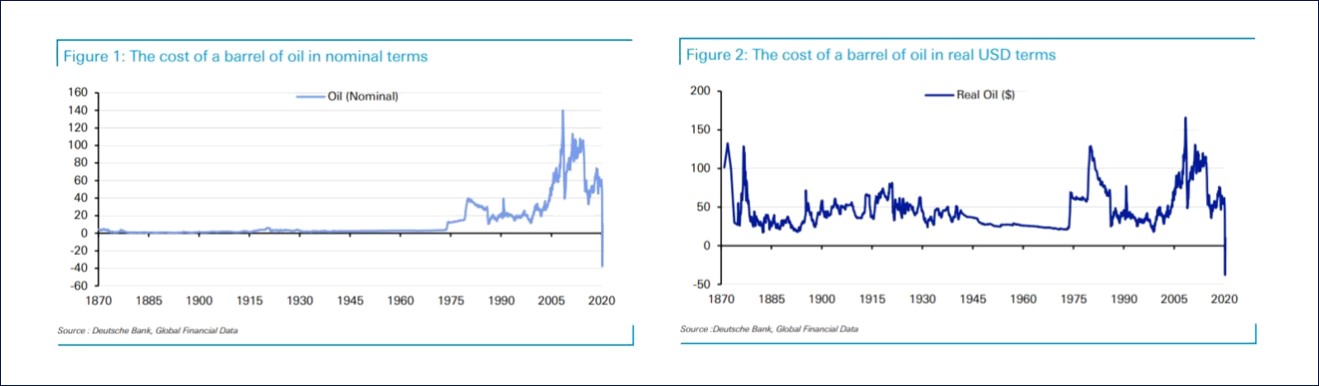

Oil fueled the 20th century. Its cars, its wars, its economy and its geopolitics. Now the world is in the midst of an energy shock that is unprecedented. As the coronavirus struck the global economy earlier this year, demand for oil dropped by more than a fifth and prices collapsed. At exactly the same time an oil price war started, triggered by Saudi Arabia in response to Russia's refusal to reduce oil production. This meant oil prices could not be kept at moderate level and started declining. Fast. This pandemic-oil-war combination resulted in something which was thought impossible.

For the first time in history, oil prices were negative. This remarkable event sent shockwaves throughout the known world. Fossil fuel producers are being forced to confront their vulnerabilities, which is becoming painfully clear. Exxonmobil has been ejected from the Dow Jones Industrial Average, having been a member since 1928. Shell CEO Ben van Beurded announced the first dividend reductions since the second world war, decreasing the value of Shell by $20 billion with a single stroke of a pen in July.

Due to these hard times for oil and gas majors, valuation of these companies on the stock market are plummeting. Apple, Microsoft and Amazon are now worth more than the combined value of all global oil and gas majors. Individually.

Faced with critical uncertainty in these confusing times, what do we do? We ask Google. When I started asking questions to Google, I noticed something peculiar. Clearly, as can be seen from the below snapshot of questions people also ask, I was not the only one wanting to know what the hell was going on with the oil and gas industry.

Although I was somewhat pleased with so many people asking these kinds of questions, I was less pleased with the answers. They lacked the depth and nuance I felt as someone active in the oil, gas and renewables industry for almost ten years now. It felt to me that these questions deserved better answers. I felt the need to answer them for myself and sharing them with you.

I will not pretend I can make an accurate prediction of what will happen in the coming years. Or more precisely, when it will happen. Adhering to the lessons I learned from Nassim Nicholas Taleb, this blog is not an outlook or forecast of the oil and gas industry. It is a dissertation of possibilities, not probabilities, based on solid underlying trends. Due to the massive upheaval in 2020, some of these trends are now clearer than ever, showing the massive underlying risks of the fossil fuel system.

Many of us now believe it is not a matter of if, but when we will transition away from fossil fuels. How the transition will take place however, whether it is gradual or rapid, peaceful or painful, is a matter of debate. As always, feel free to comment below if you see things differently.

+ Is the oil and gas industry dying?

Yes*. Most people recognize now that oil and gas is on life support. Since spring 2020, oil and gas has seen one bombshell after another, and the impacts are adding up.

The industry as we once knew it, is gone.

Many sources now suggest that oil demand has already passed its peak. If the wide variety of views can be summed up, the industry knows it’s in the worst situation in generations as far as demand goes, and that there is considerable uncertainty over how the situation will unfold in coming months and years. Other sources are stating it even more bluntly.

Biggest crisis since second world war

The International Energy Agency forecasts the Covid-19 fallout will lead to the most severe plunge in energy demand since the second world war and trigger multidecade lows for the world’s consumption of oil, gas and coal, while renewable energy continued to grow. Carbon Tracker states that the world is “witnessing the decline and fall of the fossil fuel system”. The culprits are the quicker-than-expected growth of clean energy alternatives coupled with the collapse in demand for fossil fuels amid the pandemic.

According to Kingsmill Bond, energy strategist for Carbon Tracker, fossil fuel companies and their investors have failed to realize the current decline of the fossil fuel industry. This may prove to be terminal. “The bizarre thing is that the fossil fuel incumbents have been so resistant to the idea of change for so long, and put out so much bogus PR, that they risk falling victim to their own rhetoric,” he said. “There is far more risk inherent in the fossil fuel system than is conventionally priced into financial markets. Investors need to increase discount rates, reduce expected prices, curtail terminal values and account for the clean-up costs.”

Money is gone

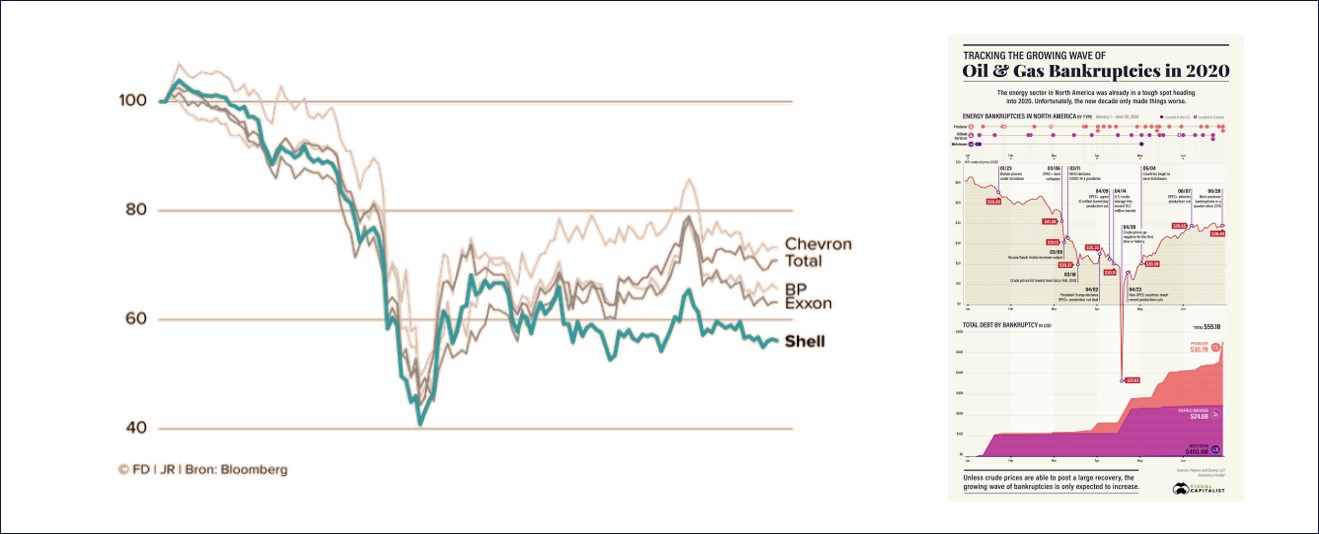

Already, stock prices of oil majors have plummeted to almost half their value compared to the start of this year, setting an unnerving precedent. The risks that the fossil fuel industry is exposed to are clearer than ever, which is shown by the unprecedented amount of bankruptcies. The second quarter of 2020 saw 18 bankruptcies, the highest quarterly total since 2016. A total of $55 billion (!) has gone up in smoke this year alone. It is believed the wave of bankruptcies will continue well into 2020 and likely beyond.

The question is, how many more are waiting to surface? What if one of the big oil companies will fail? What if this fate will befall to one of the large oil and gas majors, such as Shell? Some investors are not willing to find out. In the light of these growing bankruptcies and uncertainty, investors are now starting to pull back. Even JP Morgan Chase, the world’s biggest funder of oil and gas, is gradually pulling back financing in order to align with the Paris goals.

With financing gone, the future seems bleak for the oil and gas industry. What will lie beyond 2020 for them? Will they ever recover from this disastrous year?

Already, stock prices of oil majors have plummeted to almost half their value compared to the start of this year, setting an unnerving precedent. A total of $55 billion (!) has gone up in smoke this year alone. It is believed the wave of bankruptcies will continue well into 2020 and likely beyond. Could this happen to Shell or BP? Click here to enlarge the infographic on oil and gas bankruptcies in 2020.

*The 'only' caveat in this blog is the fact that the focus is on publicly traded oil majors. Petro-states will do whatever it takes to prop up the oil and gas industry, which will most probably lead to cheap oil for a very long time.

+ Will oil ever recover?

Unlikely, though opinions are divided into two distinct camps.

The first camp sees oil and gas as an industry that will inevitably decline as the world switches to renewables in a bid to combat climate change. The second camp sees a growing role for fossil fuels as the global population expands and hundreds of millions of people seek to join the energy-intensive middle classes, especially in Asia and Africa.

My personal opinion favors the first camp, but I will elaborate on both.

Camp 1 – No, Oil will not recover

Let’s ask the CEOs of Shell and BP what they think first. While announcing the historic decision to lower dividend for the first time since World War II, Ben van Beurden, CEO, was gloomy about a rapid recovery in demand. "I do not expect oil prices or demand for our products to recover in the medium term." He even openly questioned whether oil demand will ever return to pre-pandemic levels.

His competitor-fellow CEO Bernard Looney is not reassured either. The brand new boss of the British oil company BP hinted in an interview with the British business newspaper Financial Times that the peak in the use of oil could already have been reached. In that case, 2019 would go into the books as the peak year: from 2020 it will only decrease with demand.

The sentiment of these CEOs stems from three major underlying trends: continued growth of cheap and abundant renewables, financiers pulling out of oil and gas, and backing by favorable policies that are likely to increase in strength. As the public, governments and investors wake up to climate change, the clean-energy industry is gaining momentum. Capital markets have shifted: clean-power stocks are up by 45% this year. With interest rates near zero, politicians are backing green infrastructure plans.

America’s Democratic presidential contender, Joe Biden, wants to spend 2 trillion dollars decarbonizing America’s economy. The European Union has earmarked 30% of its 750 billion euros covid-19 recovery plan for climate measures, and its president, Ursula von der Leyen, used her state-of-the-union address this week to confirm that she wants the EU to cut greenhouse-gas emissions by 55% over 1990 levels in the next decade.

As a response to these challenging environment, oil majors are reorganizing and slashing jobs. This brain drain comes at the worst possible time. A large portion of skilled people leaving the oil and gas industry will never come back, taking the accrued knowledge and decades of experience along with them. On top of that, most young people entering the job market do not want to have anything to do with the industry. This dynamic will effectively “bleed the industry white”, making a swift recovery nearly impossible.

It is certain the industry is entering an era defined by intense competition, technology-led rapid supply response, flat to declining demand, investor skepticism, and increasing public and government pressure regarding impact on climate and the environment. In such an era of oil abundance and low demand, large oil producers will do whatever they can to hold on to market share as the total pie slowly shrinks.

Betting on rising oil demand growth is now effectively saying that global vehicle makers will fail in their multi-billion dollar investments to shift to electric cars and trucks, that renewables won’t continue to get cheaper and easier to store, that carbon taxes won’t continue to rise or become more widespread. Betting on a recovery is exactly what the second camp is doing however.

Camp 2 – Yes, Oil will recover

According to McKinsey, oil and gas will remain a multi-trillion-dollar market for decades under most scenarios. Given its role in supplying affordable energy, it is too important to fail. The fact that oil and gas products and companies are too big to fail is unnerving, but correct. It could potentially even lead to bailouts in the case we face the carbon crunch scenario, which is discussed at a later stage. What's more, the majority of “future outlooks on energy” show a continued growth in oil demand through 2040 driven by rising prosperity in fast-growing developing economies. The continued demand for oil, or hydrocarbon products in general, is something that cannot be understated.

It is an unmistakable fact that the products made from oil are needed to keep our way of life running. We should therefore not “pick sides” and discuss whether or not oil will ever recover. We should discuss how the industry should create true value, economic, social and environmental.Granted that we undeniably need the products and services provided by the oil and gas industry, we should put our efforts into pivoting the industry towards biofuels, synthetic fuels and hydrogen.

+ How could the industry recover?

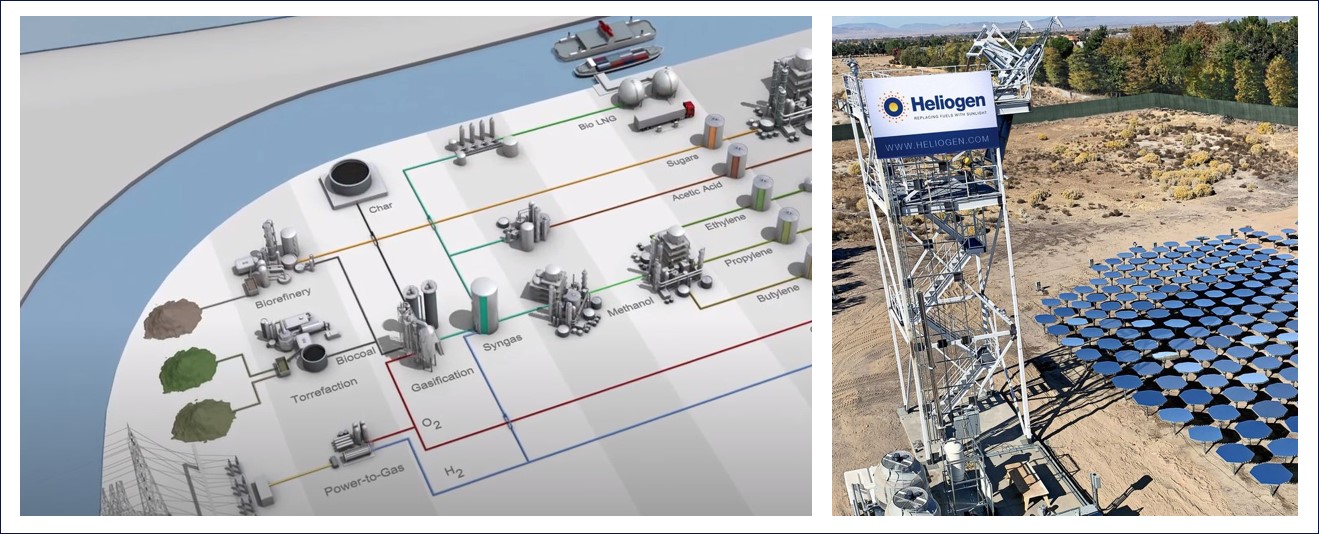

One of the ways for oil and gas to make a dramatic “recovery”, is to leverage their knowledge on chemicals to transform the fossil industry into a bio-based, synthetic and hydrogen industry. This is the topic of discussion one of my previous blogs centered around biomass.

Hydrogen and synthetic fuels made with renewable energy can potentially replace fossil fuels in all current applications, though developing and commercialising the technology and needed infrastructure will require heavy investments over a long period of time. The push towards these renewable sources of energy storage are not just backed by policy makers, but industry alike.

One example of a company already leading the charge is Chemport Europe. This is an ambitious project aiming to transform the chemical sector in the region of the North-Netherlands to a fully renewable and sustainable industry. They plan to combine green energy provided by wind turbines, biomass, solar panels and hydropower, with agricultural waste and grasses from the Northern provinces in the Netherlands as feedstock for the chemical cluster.

Another, potentially even more futuristic example is Heliogen, dedicated to making fuel out of thin air. Their goal is to create synthetic fuel by directly capturing CO2¬ and water from the air using solar power. They recently received funding from Bill Gates and could be a true game-changer in the industry.

The oil and gas industry is perfectly suited to pivot towards the biofuels industry, synthetic industry and hydrogen production industry. To the left is an example of Groningen Seaports, who want to fully power the chemical industry in the North of the Netherlands by means of biomass. To the right is the example of Heliogen, a company that aims to create synthetic fuel out of thin air, backed by Bill gates. For more on this, read our blog on the transition of fossil fuels to bio and synthetic industries.

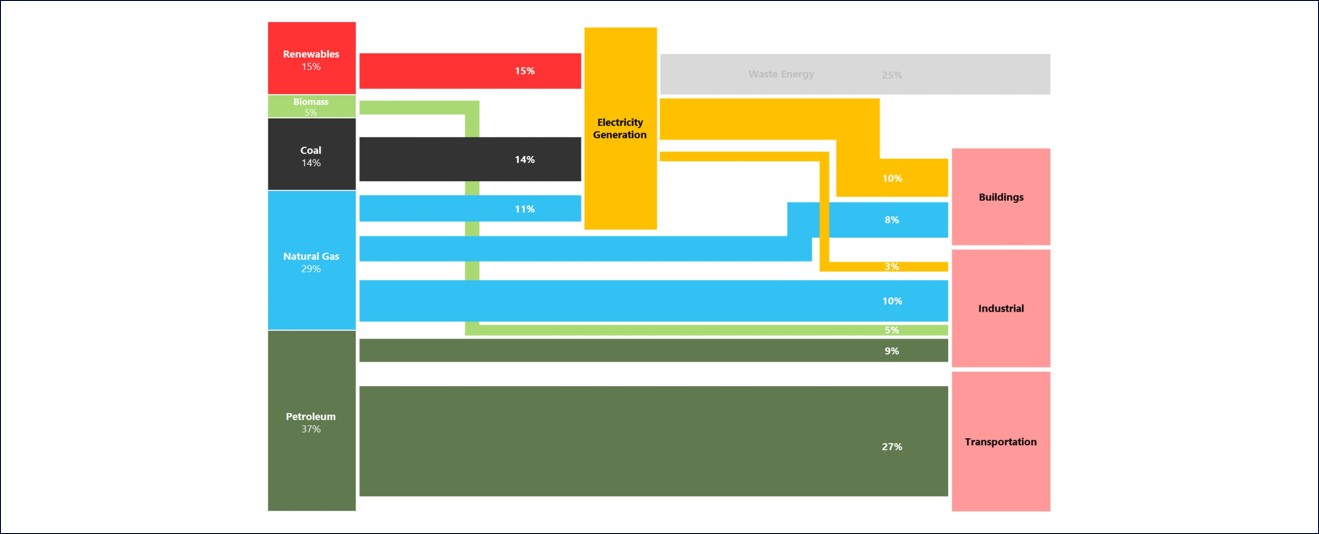

+ Which industries use the most oil?

The biggest consumer of oil is the transportation industry. Worldwide, cars planes and boats use approximately 75% of all the oil in the world. Land-based transport in term is the largest of the three, consuming almost 65% of all petroleum-based products in the world.

The fact that almost all oil is consumed by cars, combined with the extremely disruptive transition towards electric vehicles, is one of the main reasons why I personally believe oil demand has peaked and will start to decline rapidly. If you are interested in learning more about energy flows and fossil fuel consumption, check out this previous blog on how much energy we need in the world and what we use it for.

Click here to enlarge the infographic show the simplified energy flows in the U.S. in 2017.

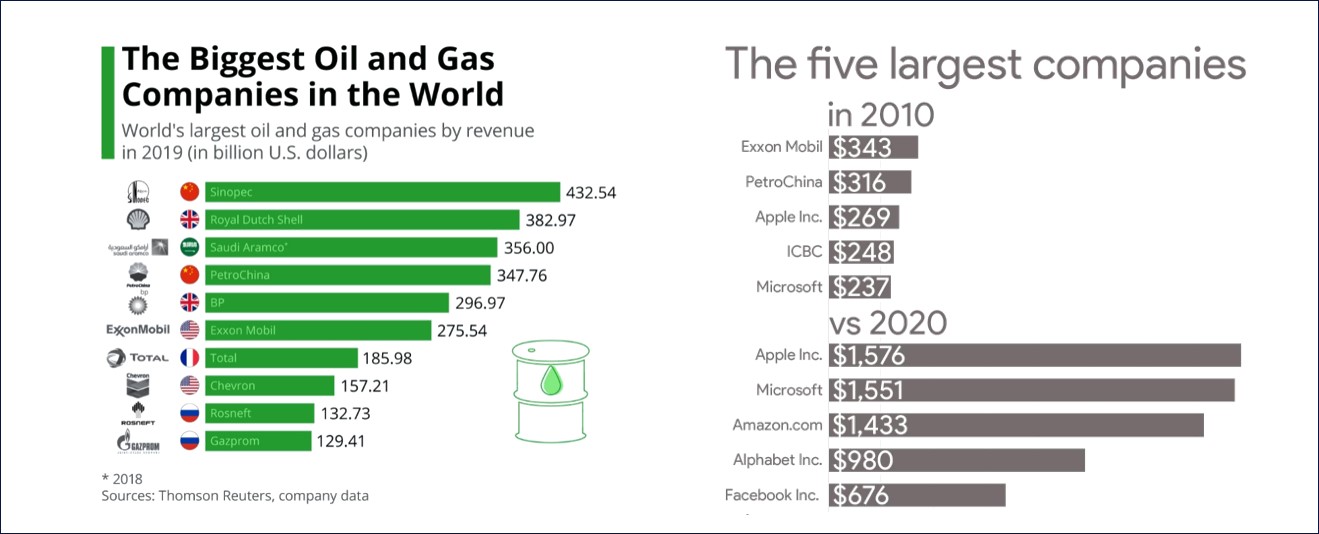

+ Who is the richest oil company?

It depends on how you measure and value the oil and gas companies. In terms of revenue, China’s Sinopec Group ranks first on the list of the world’s leading oil and gas companies of 2019 with revenues of more than US$430 billion, ahead of Shell and Saudi Aramco. Other sources yield slightly different results, but the top dogs remain mostly the same when looking at revenue only. Other ways to value oil companies could be by looking at stock price market value or proven reserves. These methods will lead to different results, but most analyses define value in terms of revenue.

Three-digit sales in the billions are not uncommon in the oil and gas industry, although revenues are highly dependent on the development of crude oil prices on the world market. This list will look markedly different at the end of this year, owing to the disruptive changes the industry is currently undergoing.

The U.S. oil and gas sector was once worth a combined $3 trillion, almost 10% of GDP. Now Apple, Microsoft and Amazon each have higher valuations than the entire sector. They also have sizable clean energy investments (not merely buying renewable-energy credits), and do not pay the massive dividends that energy companies have been doling out. Their value continues to rise despite (or maybe because of) the Coronavirus, drastically changing the financial landscape of the oil majors.

To the left are the largest oil and gas companies according to revenue. To the right are the largest companies in 2010 and 2020 according to market value (stock price). I guess it turned out that data is the now oil after all.

+ Why is oil so cheap right now?

It is a matter of supply and demand. More specifically, a steep decline in demand due to the Coronavirus and high supply due to oil price wars. A chronological look of the events in 2020 shows us what exactly happened.

Oil price developments in 2020

The new year opened with a U.S. attack on a top-ranking Iranian general in Baghdad, followed by an Iranian counterattack on two bases in Iraq that hosted U.S. military personnel. Then, the energy industry worried that the Organization of the Petroleum Exporting Countries (OPEC) wouldn’t renew its production deal with non-member countries, causing increased production and negative pressure on crude prices.

All the while, the threat of COVID-19 grew and started to spread. In March 2020, the new coronavirus hit markets hardest, right as the OPEC+ deal collapsed. Russia and Saudi Arabia subsequently flooded the markets with cheap oil, starting a price war to drive out competition.

What developed was the perfect storm of nonexistent demand matched up against oversupply. Crude prices plummeted and hit a historic sub-zero low on April 20th, with futures for West Texas Intermediate (WTI) Crude closing at -$37.63.

Oil and gas was hit with a double whammy at the start of 2020, leading up to one of the most volatile periods in the history of oil and gas. Although the industry is used to shocks and there has it has never seen periods like these before. There has been a jittery recovery since then, but a return to the old “pre-Corona world” seems unlikely. Fossil-fuel producers are being forced to confront their vulnerabilities, and this is becoming ever more painfully clear.

Periods of high volatility are inherent to the fossil fuel system. Concentration of the world’s oil reserves makes supply vulnerable to geopolitical shocks. Looking back, the oil price has swung by over 30% in a sixth-month period 62 times since the seventies. 2020 Has been unprecedented even in this regard.

+ What is the impact of Corona on oil and gas?

The Coronapandemic is accelerating the demise of fossil fuels and the rise of renewables, a trend which has been set in motion well before 2020. The pandemic has simply made it more clear to everyone.

The clear and short-term impact

What was obvious to everyone, was that the pandemic instantly took a huge bite out of global fossil fuel demand. Aircraft stayed on the ground, a large part of the world's population worked from and is still working from home. According to the International Energy Agency, crude oil demand fell by 25 million barrels per day in April alone. That is a quarter of the global demand from before the corona crisis and an unprecedented sharp decline.

As the transportation industry uses the most amount of oil, the working from home policies hit especially hard. Even if everyone uses the car en-masse again, 2020 will most likely go down as the worst year for the oil industry ever. And that is only if everyone takes the car again, which seems unlikely given second or even third lockdowns in many countries.

The crisis has furthermore led many to discover the benefits of video calling. Taking a plane for a meeting suddenly seems like something from another era. Large groups of employees and their supervisors find out that working from home is actually quite possible. Even though working from home all the time does not seem to work for everyone, working from home some of the time seems to be here to stay.

The less clear and longer-term impact

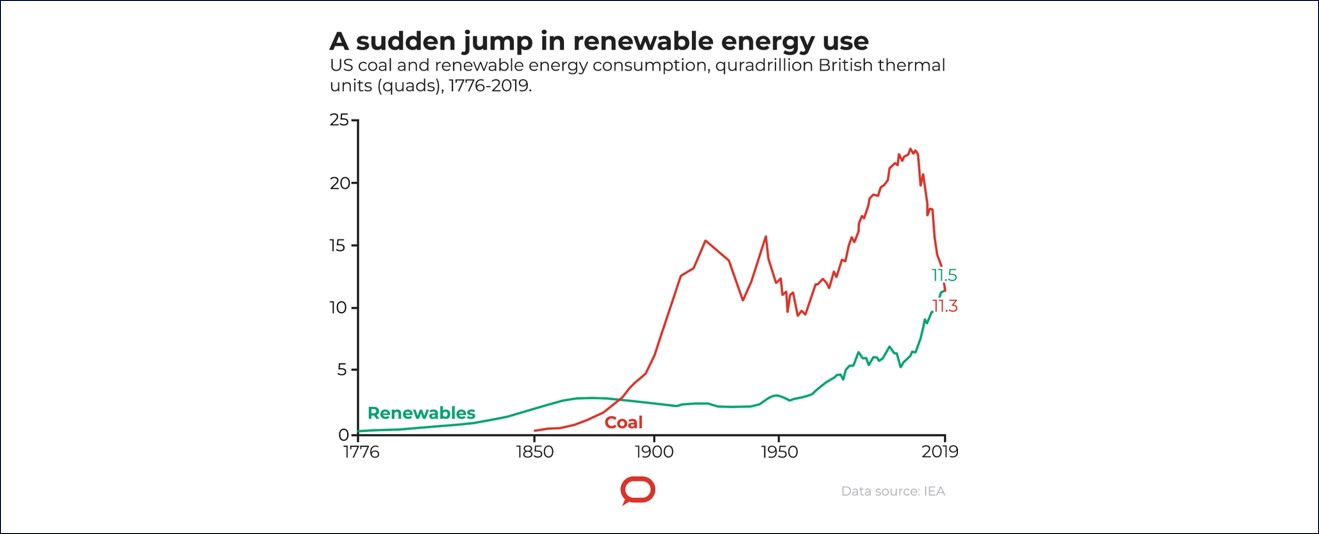

One of the underlying trends in energy over the past decade, is the slow but steady transition to a decentralized and mostly electric energy system. The following graph for renewable energy and coal consumption in the United States shows the transition towards renewables is well underway. This was set in motion well before Corona and it is expected this trend will continue, even accelerate.

It is undeniable that the current crisis will have a profound impact on the industry, both for the short and long term. After the crisis has subsided, leading companies will use the crisis to redefine their reasons for being and their basis for distinctiveness. So what are the different oil and gas companies doing in terms of redefining their purpose? What is their view on the energy transition in these times and are they investing in it? How far – and how fast – are the giants of fossil fuel production willing to go in their pursuit of decarbonization?

Coal is the clearest example of the trends that has been set in motion since the late 2010s: a stark rise of renewables contrasted with a steady decline in fossil fuels.

+ Which majors are performing best in the energy transition?

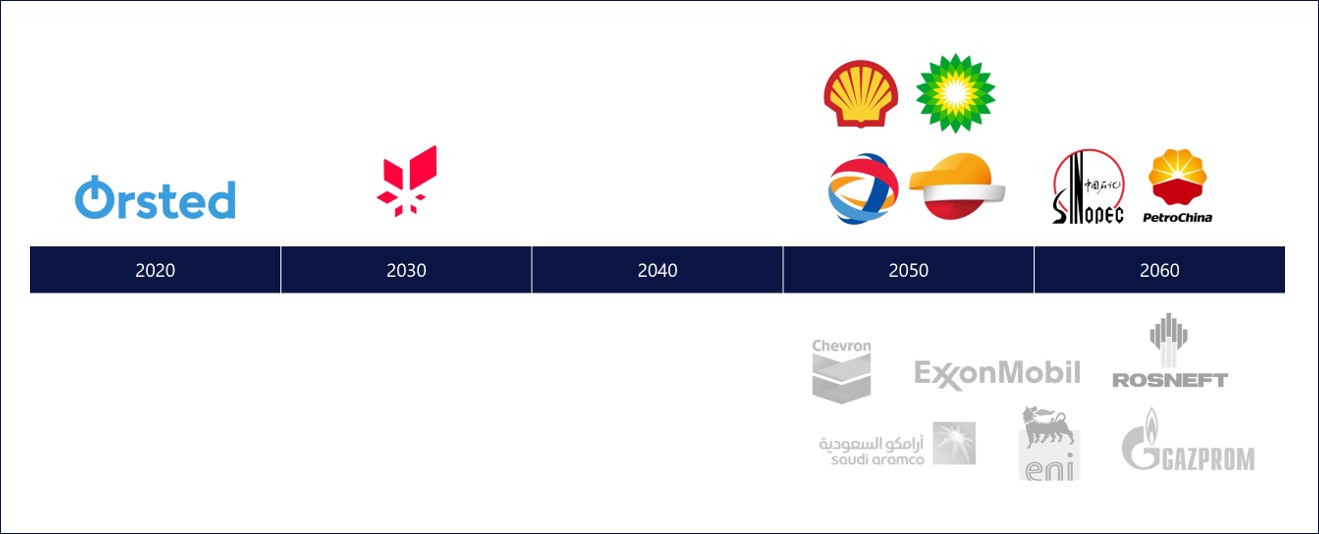

Ørsted and Equinor lead the charge, with Shell, BP and Total following. Especially state-owned oil majors have done relatively little to nothing with regards to the energy transition, with the notable exception being Equinor (and perhaps China in the future). The signs of a renewables revolution are clear for everyone to see, including even the US-based laggerds, leading to the ambition of most majors to become energy majors instead of oil and gas majors.

From oil to energy majors

In the last three years, global oil and gas companies have branched out into new sectors, ramping up investments in the power sector, low-carbon technologies and mobility, as they respond to intensifying climate campaigning that has also spurred activism among their traditional investors.

S&P Global Platts’ Power Plays Database, which tracks eight international oil and gas companies’ approaches to the energy transition, reveals several distinct strategies. Broadly speaking, the six Europe-based majors surveyed have launched more enthusiastically into both renewables and the utilities space than the two US-headquartered companies.

Of these companies, Total, Shell and BP have invested most into renewable energies. The majority of these investments have been made in the last few years, such as Total winning Europe’s largest electric-vehicle charge point contract in the Netherlands, partnering with Groupe PSA in a pilot battery facility and taking a 2 GW Spanish solar position.

Distinct strategies, small budgets

While sentiment among the oil majors is thus definitely changing and investments are ramping up, they remain modest compared to the size of their overall capex. The International Energy Agency says investment to date by oil and gas companies outside their core business areas is less than 1% of total capital spend. “A much more significant change in overall capital allocation would be required to accelerate energy transitions,” it said in January.

In the same month Shell CEO Ben van Beurden said he “regretted” missing out on purchasing Dutch sustainable energy utility Eneco last year, outbid by a consortium of Japan’s Mitsubishi Corp and Japanese utility Chubu Electric Power Co in a $4.5 billion deal. Van Beurden said that to succeed in the competition, Shell would have “busted” its “new energies” budget, illustrating how competitive the market is for transition plays – and how cautious big oil remains when presented with a relatively modest stepout opportunity.

Decarbonization Ambitions

Apart from investments into renewables, one of the most important aspects of the energy transition and climate-change is decarbonizing the business. Adhering to the climate goals of the Paris Agreement is coming more in vogue, even under the state-owned petro-companies who invest little in renewables.

BP’s aspirations, although thin on detail, have upped the ante with new CEO Bernard Looney in February committing the company to net-zero carbon emissions by 2050, implying a fundamental shift over the coming decades to renewables and carbon abatement. On top of that, BP stated to slash oil production by 40% and pour billions into green energy. Shell followed suit in April, also announcing a target of net-zero emissions by 2050, along with greater cuts to the carbon footprint of its products compared with previous announced goals.

The Scandinavian majors are even more progressive. Ørsted has already fully transitioned from black to green energy, phasing out fossil fuels and doubling down on wind energy. Equinor has a progressive climate roadmap and aims to reach carbon neutral global operations by 2030, with rumors that is wishes to speed up this agenda. It is not just the publicly owned companies who claim to become carbon neutral. China is working towards becoming carbon neutral as a country by 2060 (link).

Not everyone is on-board the carbon neutral boat however.

US doubling down on fossil fuels?

American oil giants Chevron and Exxon Mobil are going in a far different direction. They are doubling down on oil and natural gas and investing what amounts to pocket change in innovative climate-oriented efforts like small nuclear power plants and devices that suck carbon out of the air. On paper and in public, everyone agrees that climate change is a threat and that they must play a role in the energy transition. But the urgency with which the companies are planning to transform their businesses could not be more different.

“Despite rising emissions and societal demand for climate action, U.S. oil majors are betting on a long-term future for oil and gas, while the European majors are gambling on a future as electricity providers,” said David Goldwyn, a top State Department energy official in the Obama administration. “The way the market reacts to their strategies and the 2020 election results will determine whether either strategy works.”

It goes to show that there remains much disparity amongst the biggest oil and gas companies on the strategies to follow. State interests also intervene with political ambition, though Norway and China appear to be setting the stage. Perhaps the unintentional betting by different companies on multiple strategies is a sure case for at least one to win. How long do we need to wait however to see which strategy will win?

Ørsted and Equinor have the highest ambitions when it comes to becoming carbon neutral. Shell, BP, Total and Repsol all have ambitions to become carbon neutral around 2050. China (and its state-owned oil companies) have the ambition to become carbon neutral by 2060. The other listed companies do not have made public their intentions of becoming (fully) carbon neutral.

+ How fast will the energy transition be? When is peak oil?

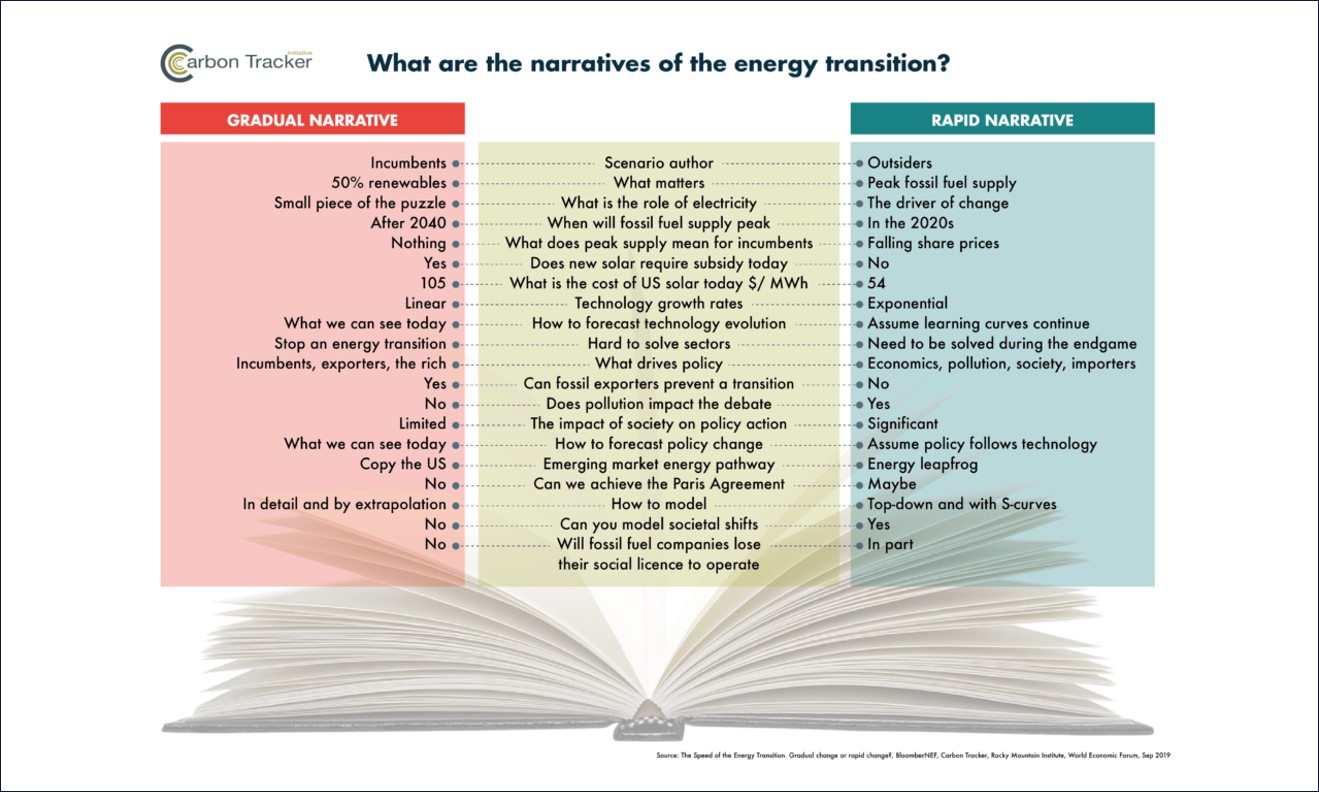

It is without a doubt that the industry will transform. Whether global peak oil was already reached in 2020 or beyond the horizon in 2030, everyone including big oil itself expects the growth in demand for oil to decline. Most sources state the peak to be around 2030. The key issue might not be when the transition occurs, but rather if the transition will be gradual and painless, or rapid and painful.

A gradual transition takes decades, which means that we miss the goals of the Paris Agreement but energy sector incumbents can continue to flourish. A rapid transition takes place mostly within the next decade, which means we have a chance of hitting the goals of the Paris Agreement. In the most extreme case, the industry will be severely disrupted by the speed of change and could collapse.

There are advocates of both gradual and rapid growth under investors, policy makers, business people and other stakeholders. The narratives they uphold can be divided into four distinct areas.

Stock vs. Flow

Gradual advocates focus on total demand (stock) and argue that new energy technologies are relatively small and will take decades to overtake fossil fuels. Rapid advocates focus on change (flow), and argue that new energy technologies will soon make up all the growth in energy supply.

Linear vs. Exponential Technology Growth

Gradual advocates argue that new energy technologies are expensive and face insoluble economic or technical impediments to growth, meaning that growth rates will be only linear. Rapid advocates argue that solar and wind are already cheaper than fossil fuels for the generation of electricity and that Electric Vehicles (EV) are about to challenge the Internal Combustion Engine (ICE) on price, that the barriers to growth are soluble for the foreseeable future, and that these disruptive new energy technologies will continue to enjoy exponential growth. They anticipate the rise of new technologies such as green hydrogen which can lead to further waves of change.

Static vs. Dynamic Policy Making

Gradual advocates argue that it is necessary only to model policies which we know will happen, that the forces of inertia are very powerful, and that policymakers will remain cautious and slow-moving. Rapid advocates argue the forces for change are considerably greater than those for inertia, and that technology opens up the opportunity for policymakers and regulators to design markets to better provide for all consumers’ needs. As the necessity for action becomes clear, so there will be an inevitable policy response. Modelling only the existing policy environment has the impact of understating trends in policy making.

Copy vs. Leap Frogging Markets

Gradual advocates argue that the emerging markets (including China) will broadly follow the path taken by developed markets and use more fossil fuels as they get richer and energy demand rises. Rapid advocates argue that the emerging markets will enjoy an energy leapfrog to new energy technologies and significantly less energy-intensive forms of economic development while providing critical improvements in the quality of life.

Click here to enlarge infographic.

+ What is the carbon crunch scenario?

In the worst case scenario, a rapid and sudden energy transition could descend into a full-blown collapse of the fossil fuel industry, referred to as the “carbon crunch” scenario by some. Such a transition could pose a significant threat to global financial stability by wiping out the market value of fossil fuel companies.

A severe blow to fossil fuel companies could thus send shockwaves through the global economy because their market value makes up a quarter of the current world’s equity markets and they owe trillions of dollars to the world’s banks. It seems that there is far more risk in the fossil fuel system than is conventionally priced into financial markets. Investors therefore need to increase discount rates, reduce expected prices, curtail terminal values and account for the clean-up costs. The stakes are higher than simply financial however.

Besides financial collapse, the other big risk is the transition of petro-states, like those in the OPEC cartel or Russia, which account for 8% of world GDP and nearly 12% (900 million) of its citizens. As oil demand dwindles, they face a vicious fight for market share which will be won by the countries with the cheapest and cleanest crude. Even as they grapple with the growing urgency of economic and political reform, the public resources to pay for it may dwindle. This year Saudi Arabia’s government revenue fell by 49% in the second quarter. A perilous few decades could lie in store.

What is the Future of Fossil Fuels?

Winter is coming

The 21st-century energy system promises to be better than the oil age: better for human health, more politically stable and less economically volatile. The shift involves big risks. If disorderly, it could add to political and economic instability in “petro-states” and concentrate control of renewable energy technology and supply into the hands of a few. Even more dangerous, the transition could happen too slowly, resulting in climate-change potentially even more disastrous.

Against a backdrop of a global pandemic and market uncertainty, the oil and gas industry faces an existential challenge in the decades ahead. Will it maintain focus as a sunset industry, gradually cashing out its business model to grateful investors? Will it continue to reposition itself incrementally in sustainable fuels and energy markets? Will the majors go out with a bang, or die out with a whimper?

In the near term, it seems likely that we will see a more prudent accrual of start-ups. In the mid-term, it would not be surprising if one of them seeks to differentiate itself from the pack with a step-out acquisition, like Shell tried with Eneco. In the long-term, with a decline of oil demand and market value, either mergers or bankruptcies (including the possibility of bailouts) seem more likely.

With pressure from governments and investors on producers of hydrocarbons intensifying, those oil and gas producers that stay on the sidelines and resist a bigger shift may find they have missed the boat later on.

+ Personal Note

“I have seen the peak”

In retrospect, the heydays of oil and gas industry might have occurred while I was studying offshore engineering at the TU Delft in 2011 to 2013. The future was bright and oil reached the highest of highs in 2014, right after I landed my first job as Jr. Engineer in the industry. Back then, the talk of the town was oil scarcity. I remember endless debates on “how much oil was left” and whether there would be oil wars because of the lack of black gold in the future. These issues where the main theme of many dystopian movies and games, such as Mad Max and Fallout. It is almost eerie how quickly this narrative changed. We now realize the problem is not oil scarcity, it is the opposite. We probably have more than enough to last us a few lifetimes.

This became increasingly clear after the steep oil price decline in 2014. Since then the industry has been in countless cycles of downscaling and reorganizing, faced with the paradigm shift from an age of (perceived) scarcity to an age of abundance. I already wrote about this back in 2018, where I highlighted the role of incredibly cheap renewables and the impact they would have on the industry. It seems even my own most optimistic views could have been low estimates of what was to come.

What lies beyond the peak

Most of you know that I am a big advocate of change towards a decentralized and electric energy future. On top of that, I am quite the optimist. I personally estimate the current non-linear growth trends in renewables have the potential to reduce the use of fossil fuel by 80% in a decade. The speed of transition is something I aim to look at in more detail in the future. The only thing that will put the brake on these technologies becoming the core of a new economy are backward-looking government policies that seek to prop up an obsolete fossil-fuel economy. Eliminating the last 20% after 2030 – most likely gas and coal used in industrial processes such as steel production and mineral processing or heating – will be harder but doable. I described several potential pathways in my blog about biomass and how to divert energy flows away from fossil fuels. This process will and should take time, perhaps more than a decade, as change comes at a cost.

Considering the fact that the oil and gas industry makes up for about 10% of world GDP, it would be a bad thing if it all came crashing down. Which it could. I truly believe that we have not seen the end of the oil bankruptcies. I for one would not be surprised if one of the bigger majors needs a bailout in the coming year. Although this truly is speculation, it feels to me that we need to be think about these kinds of possibilities. The fact that we experienced negative oil prices - a fact that seemed stranger than fiction - goes to show that anything goes.

Assume ignorance over malevolence

One last thing I would like to mention, as someone who has been active in the oil and gas industry for almost ten years, is that I truly think that most captains of industry believe they are doing the right thing. For example, BP’s new CEO Bernard Looney, who has taken a totally different course than his predecessors is focusing heavily on shifting away from fossil fuels. Starting earlier this year, his narratives are 180 degrees opposed to what I have ever heard before. He acknowledges that there is a fixed carbon budget, and claims that the corona-oil-crisis combo have accelerated their drive away from fossil fuels. He actually stated “given the choice, I would choose my grandchildren. Everytime.” These are words struck a cord with me.

On might become cynical when reading this, especially if you are a (nature) activists. I have seen these C-level directors up close however and do not think they are malevolent. I was touched by a quote from Elon Musk that, for me, told precisely what I believe is the unspoken sentiment of my industry.

“For a lot of the people in the oil and gas industry, especially if they’re on the older side, they built their companies and did their work before it was clear that […] climate change was a serious issue. And now they feel probably hard done by, that people are making them out to be villains, when they’re for the longest time just working hard to support the economy, and didn’t really know that it would be all that bad.”

If you are working in the oil and gas industry and feel the same way, remember that you too can make a positive impact. Redirect your own and your companies’ resources into non-fossil fuels, biofuels, synthetic fuels, hydrogen or solar and windpower. Even the smallest of actions can have a significant impact as long as we continue to do so over time. And remember, we do not have that much time left.

References & Further Reading

VOX Youtube - How America can leave fossil fuels behind, in one chart | 2020 Election

Mr. Sustainability - Is there enough biomass to fuel the world?

Business Insider - Three companies that are bigger than the entire oil and gas industry.

Financieel Dagblad - De vraag naar ruwe olie komt (n)ooit weer op het oude niveau

Financieel Dagblad - De coronacrisis en Shell

Reuters - Crude oil industry is starting to hear echoes of coal's demise: Clyde Russell

The Guardian - Coronavirus crisis could cause $25tn fossil fuel industry collapse

The Economist - Is it the end of the oil age?

Visual Capitalist - Tracking the growing wave of oil and has bankruptcies in 2020

Cleantechnica - JPMorgan Chase, World’s Biggest Funder of Fossil Fuels, Commits to “Paris-Aligned” Financing

The Conversation - Creative destruction: the COVID-19 economic crisis is accelerating the demise of fossil fuels

McKinsey - Oil and gas after COVID-19: The day of reckoning or a new age of opportunity?

Statista - The biggest oil and gas companies in the world

Carbon Tracker - Clean tech and climate policy could cut fossil fuel profits by two thirds

Carbon Tracker - The speed of the energy transition

Global Platts Insight - Big oil and the energy transition

New York Times - US Oil giants doubling down on fossil fuels

CNN - BP will slash oil production by 40% and pour billions into green energy

LinkedIn - Bernard Looney, CEO BP