Tesla’s Battery Day from a Maritime Perspective

Tesla’s success could spill over into adjacent transport sectors

Summary - Using Tesla’s announcements of Battery Day, DNV expects the cost of batteries to be reduced by 56% (measured in $/kWh) by 2025. Worldwide, DNV predicts that passenger electric vehicles are likely to start outselling their internal combustion engine counterparts from 2032 onwards. In North America, Europe and China this will take place well before 2030. On the assumption of success on all fronts, Tesla will achieve the critical battery density for short range electric airplanes – namely 400 Wh/kg with high cycle life.

This article is taken from DNV GL. For the original, click here.

Tesla Battery Day event finally happened. Elon Musk made some big announcements. The company is planning to get rid of Cobalt in their batteries and to manufacture its own “tabless” batteries, called 4860 cells. This type of battery is six times more powerful, and the range will be increased by 16 percent. The new battery technology will make a $25,000 Tesla car a reality. Tesla Model S with Plaid powertrain also was announced, which can reach 60 mph in less than 2 seconds and break records on tracks. Max speed: 200 mph.

A Decentralized and Electric Future

Tesla’s mission is to accelerate the world’s transition to sustainable energy. On 22 September 2020, the company announced several measures to radically reduce the cost of Electric Vehicle (EV) batteries, while boosting their range. Tesla announced a package of innovations to be implemented over the next 2-3 years that are designed to:

reduce the cost of batteries by 56% (measured in $/kWh)

increase range (per kg of battery) by 54%

reduce the investment cost per kWh of manufacturing capacity by 69%

If it hits its targets, Tesla will almost certainly be producing the most cost-effective lithium-ion batteries globally and will accelerate battery deployment worldwide. The implications for the auto industry are huge; it effectively signals the end of the internal combustion engine. In DNV’s and Mr. Sustainability’s view, Elon Musk has been justifiably disappointed by the media response to the Tesla ‘Battery Day’ announcements.

Implications of battery developments for the maritime industry

DNV, a global consultant for the maritime industry, examined whether Tesla’s ‘Battery Day’ announcements will advance its mission with reference to their Energy Transition Outlook to 2050. DNV is forecasting a rapid energy transition, characterized by a more-than-doubling of electricity in the energy mix by 2050. They predict that by mid-century more than 60% of that electricity will be supplied by variable renewable sources (i.e. solar Photo-Voltaic (PV) and wind, in roughly equal shares), requiring a very large amount of storage to supply stability and flexibility to an energy system reliant on variable sources of power. For that reason, developments in battery storage are critical, and Tesla’s innovations, summarized below, have a significant bearing on future developments. Not just on the uptake of electric vehicles (EVs) but on the energy system as a whole.

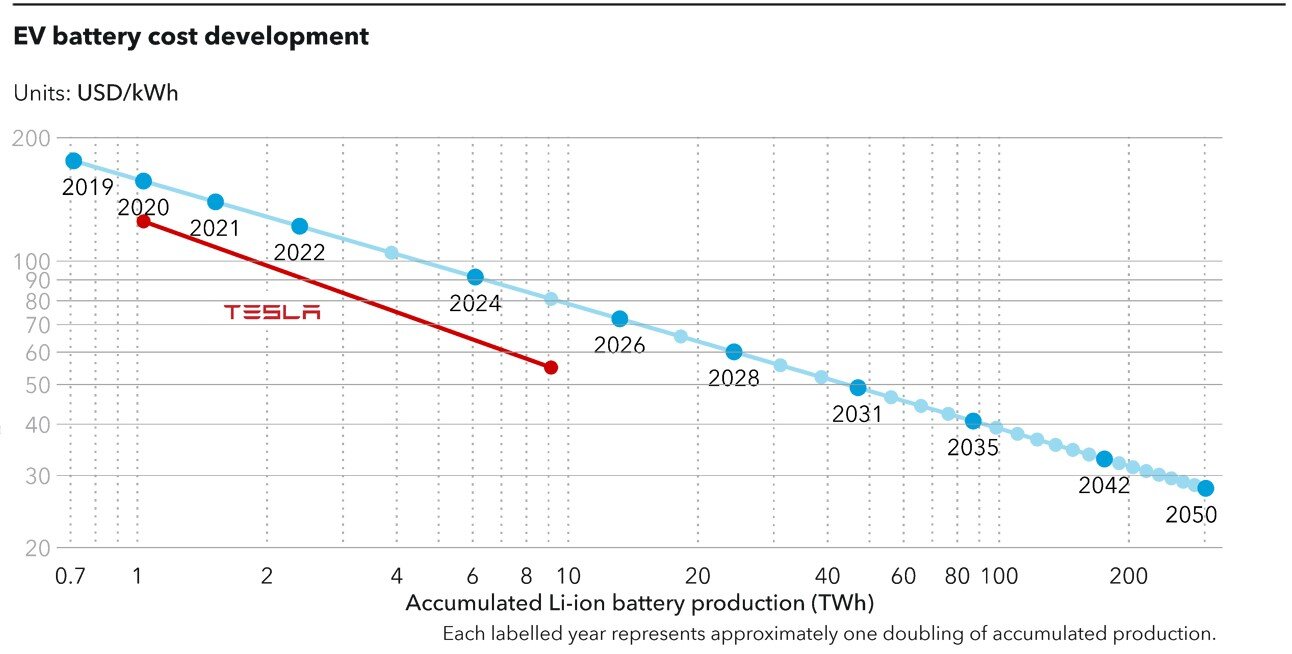

Over the forecast period, DNV expects battery costs to reduce by 19% for each doubling of installed capacity. The forecast indicates global battery capacity additions of 430 gigawatt-hours (GWh) in 2020 growing to almost 4 terawatt-hours (TWh) in 2025 – based on an average cost of 156 $/kWh in 2020 declining to 80 $/kWh in 2025. This is one of the main drivers behind DNV’s prediction that 50% of new passenger vehicle sales globally will be electric by 2032.

It is not the intention here to defend Tesla, or to analyze the implications of its announcement on the future performance of that company. Instead, DNV focuses on Tesla’s overarching mission statement: to accelerate the transition to renewable energy. DNV compared Tesla’s projections with their own energy transition forecast.

Broadly speaking, they find the company’s projections to be in line with DNV forecast. In other words, Tesla is doing what it must do to keep up with forecast developments – and to the extent that it may run ahead of DNV’s predictions, that would be in keeping with its status as a market leader. If Tesla’s production ramp-up is achieved, DNV shows how it will rapidly gain a very significant share of the battery market (of over one third by then end of this decade), and will indeed be in a position to lower the cost curve on its own – in addition to spurring corresponding competitive action.

Tesla’s projected developments is assessed on three fronts: cost, electric vehicle uptake, scale and impact on the energy transition.

Battery cost forecast

Tesla’s current dollar cost per kWh is a closely-guarded company secret. However, it is generally thought that, with its current partnerships (Panasonic, CATL and LG Chem) Tesla is some 20% below the market average cost. DNV figures suggest a market average in 2020 of 156 $/kWh, which implies Tesla’s current cost level is around 125 $/kWh.

With a 56% cost reduction, Tesla would be on track to achieve a battery cost of around 55 $/kWh before 2025. That is significantly below the benchmark number of 100 $/kWh at which electric vehicles are widely thought to reach cost parity with internal combustion engine vehicles (ICEVs). However, that assumes that the company gets all five of its battery innovation ‘ducks’ in a row (see last section) and ramps up to full production of its new battery pack on target. That is a big assumption, given the company’s habit of stretching production deadlines in the past. Nevertheless, Tesla may well run ahead of our forecast battery cost of $50/kWh in 2030, and in doing so it would solidify its status as a market leader.

In essence, the company is racing against the industry cost learning rate (CLR) for battery cells, which DNV has calculated at 19% for each doubling of installed capacity.

Electric Vehicle Uptake

Tesla plans to produce 20 million electric vehicles per year by 2030, 50 times its 2019 production. Much of these projections are based on the inclusion of a $25,000 electric vehicle “within the next three years” – as announced at the recent Battery Day. There are already several electric vehicles at that price range, but none with sufficient utility for owners (a combination of cost, range, access to charging etc.) to be truly head-and-shoulders better than an average priced petrol car. Adding a lower-priced vehicle to its portfolio would position Tesla to capture 45% of our projected 45 million passenger electric vehicles sold in 2030.

For the last four years, DNV has predicted that electric vehicles will reach total cost of ownership parity with the internal combustion engine around 2022/2023. However, private buyers of vehicles tend to be more motivated by purchase price than total cost of ownership, hence lowering the upfront purchase price is a key to accelerating electric uptake worldwide. Tesla’s strategy of adding a ‘budget’ vehicle to its fleet will help to make that happen – but it will still be producing a large number of its more expensive vehicles and using the premium to finance innovation. As such, its portfolio is ideally tailored for future developments in the North American market – where DNV predicts electric vehicles will start outselling their internal combustion engine counterparts before 2030. It is also well-positioned in Europe and China, where a similar cross-over to electric vehicles will take place before 2030. Worldwide, DNV predicts that passenger electric vehicles are likely to start outselling their internal combustion engine counterparts from 2032 onwards.

Tera Scale

To appreciate the true scale of Tesla’s ambitions, DNV calculates that producing 3T TWh of battery capacity by 2030 would give Tesla a 40% share of the world battery market – from virtually zero today (see below). 3 TWh is what the International Energy Agency (IEA) predicts for total global electric vehicle battery capacity in 2030 under its “Sustainable Development Scenario,” based on the climate goals of the Paris Agreement. Tesla emphasizes that it will continue to source batteries from its current suppliers as well, which would enable the company to capture a higher share of the EV market than its own battery production would otherwise allow.

The ramp up plan from its pilot lithium-ion battery plant in California, with its 10 GWh annual capacity, includes an order of magnitude leap for Tesla to 100 GWh by 2022 before ballooning to 3 TWh by 2030.

What is highly relevant but somewhat hidden between the lines in the announcement on Battery Day is the focus on “building the machine that builds the machine”. The major focus from Tesla is to remove as many obstacles as possible to increase production and achieve higher output. This is evident from the new design of the ’jelly roll’ in the battery to the inclusion of the battery as a structural component of the car chassis, enabled by what will be the world’s largest aluminum casting machine.

Time will of course be the judge as to whether plans to boost output exponentially are achievable. Successful progress may well spur faster growth amongst its competitors (with whom Tesla is open to licensing software and supplying powertrains and batteries) and a growth in the total battery and electric market that exceeds DNV’s forecast. But between now and such an eventuality lie many possible black swans that include several unclear details associated with Tesla’s Battery Day announcements, not least the company’s plan to vertically integrate and control the full value chain from mine to recycled battery. As the Tesla executives themselves repeatedly stressed, the leap from pilot to full-scale manufacturing is extraordinarily challenging.

DNV’s Verdict

The Battery Day announcements are largely in keeping with DNV forecast developments on electric vehicle batteries. Should Tesla fulfil all its ambitions on this front, it may catalyze faster uptake of electric vehicles – both passenger and commercial. Success could spill over into adjacent transport sectors. For example, on the assumption of success on all fronts, Tesla will also more than achieve the critical battery density for short range electric airplanes – namely 400 Wh/kg with high cycle life. Indeed, Elon Musk recently stated this could happen within three to four years.

As DNV details in its full Energy Transition Outlook report, even the rapid energy transition they forecast is not fast enough for the world to meet the ambitions of the Paris Agreement. To do so requires not only much more renewable energy, but also a great deal more energy efficiency and carbon capture and storage applied especially to those sectors where emissions are (allegedly) hard to abate – for example in long distance heavy transport and in industrial processes requiring high heat.

Tesla’s main impact will be through accelerating electric vehicle uptake and in advancing renewables. In other words it is pushing against an open door in tackling so-called ‘easy to abate’ sectors. Furthermore, its expansion plans are consistent with our forecast, which, as we conclude, is not fast enough.

That is not to say that Tesla will not shift the needle on the transition. By how much remains to be seen as this is also dependent on its ability to make a material difference to the utility-level storage market. Second-order effects might include spurring even greater expansion of renewable sources of power, such that surplus energy may become available for an earlier scaling of electrolysis based production of hydrogen than we forecast. In DNV’s view, it is too early to make a call on the long-term impact of Tesla on sectors beyond those that are easy to abate.

From a sustainability perspective, DNV applauds Tesla’s plans to eliminate cobalt use in batteries, and in targeting the possibility of reducing large amounts of wastewater use. They caution, however, that the world cannot simply build its way out of the climate crisis. Technology can certainly deliver the required energy transition, but only against the backdrop of bold policies and regulations accompanied by behavioral shifts towards sharing and circular economic models.

Tesla’s Battery Day 2020 - Innovation Summary

To achieve its ambitious objectives, Tesla is innovating on five fronts:

+1. New cell design

Tesla revealed its new 4680 cell architecture, significantly larger than the current 2170 cells used in the Tesla Model 3 and Model Y. All things being equal, larger cells would imply greater weight and thermal challenges, but Tesla is tackling that with its new ‘tabless’ architecture. Essentially this means removing the two tabs connecting the battery cap and can to the ‘jellyroll’ anode/cathode and replacing that with a spiral architecture allowing many more points of connection, increasing efficiency and reducing resistance. The net effect is a form factor with a 6X increase in power (critical for the heavy work undertaken by, e.g. the Tesla Semi) and which allows for a 16% increase in range, while reducing $/KWh costs by 14%. That in itself is impressive, but more impressive still is that the 4680 cell is designed with mass production in mind – it uses less steel and is easier to assemble.

+2. New cell factory configuration

Tesla is investing significant effort in production-line efficiency for its own production of cells – drawing inspiration from constant-motion plant technology, e.g. in the bottling industry. More significant, however, is Tesla’s new ‘dry electrode’ technology replacing the current standard ‘wet’ method that relies on enormous drying ovens. The new dry, or powder-into-film, process allows for a 10X reduction in energy use and floor space – both a significant saving and an environmental win. Importantly, it should be noted that while Tesla is now on its fourth ‘dry coating’ machine, a full build out of the new line is some 3 years away. Assuming that happens, it will contribute the biggest share (about one third) of the steps that the company is taking to reach is goal of cutting $/KWh costs by more than half. It also accounts for more than a third of the projected 69% reduction in investment per GWh requirements.

+3. Anode material

Tesla plans to reduce the volume and weight of its cell anodes by replacing graphite with more-efficient metallurgical grade silicon crystals. These will be stabilized in an ion-conducting polymer that avoids the problem of silicon expanding as lithium ions move through it. The company did not provide a timeline for this innovation – which is not entirely unique to Tesla – but the implication is that this will be its standard approach within a three-year horizon. While the overall contribution to battery cost reduction is 5%, the big benefit is a predicted range increase of 20%.

+4. Cathode material

The planned battery chemistry changes to the cathode hold substantial cost benefits (-12%), and marginally increase range (4%). Here the goal is to eliminate expensive and ethically problematic cobalt in favour of a nickel-rich cathode. Tesla will add ‘novel coatings’ to the nickel to provide stability in the absence of cobalt, resulting in a 15% reduction in $/KWh cost. The hiccup is that this will drive up nickel demand, prompting CEO Elon Musk to issue a call to nickel miners to increase production. Tesla is also looking to diversity with a three-tiered approach to cathode chemistry, using cheaper iron for medium range vehicles, a nickel/manganese combination for ‘medium-plus’ range and a high nickel content for long range vehicles like the Semi and Cybertruck. The company also plans to build a cathode making facility in North America to reduce miles travelled by nickel by 80%. The cathode plant would be co-located with a lithium conversion facility that will deploy a new sulfate-free recovery process (that relies on adding table salt to lithium clays) ,eliminating the current use of harmful chemicals and large amounts of waste water.

+5. Cell vehicle integration

Taking inspiration from the evolution of aeroplane fuel tanks – where rather than designing fuel tanks to fit into wings, the wings became the fuel tank – Tesla envisages its future battery packs to do the same sort of double duty: supply both power and structural rigidity. This is enabled by two innovations. The first is a new single-casting approach, facilitated by a novel aluminium alloy for both the front and rear ends of the vehicle, allowing the structural battery to effectively become the floor pan connecting the two ends. The second innovation is that rather than surrounding the cells with coolant, they will be packed together and surrounded by epoxy, creating a very rigid single structure with coolant distributed in a layer below the pack. This not only offers superior thermal management, but allows for the removal of redundant steel supports, adding to the weight reduction gains already made by the large form cells that reduce the overall use of steel in the battery pack by up to 40%. With better cooling and weight reductions, Tesla estimates a range increase of 14%, with cell vehicle integration lowering costs by 7%.